The administration of President Bola Tinubu is looking to attract funds held in domiciliary accounts and funds held by Nigerians abroad into massive investments in various sectors of the economy.

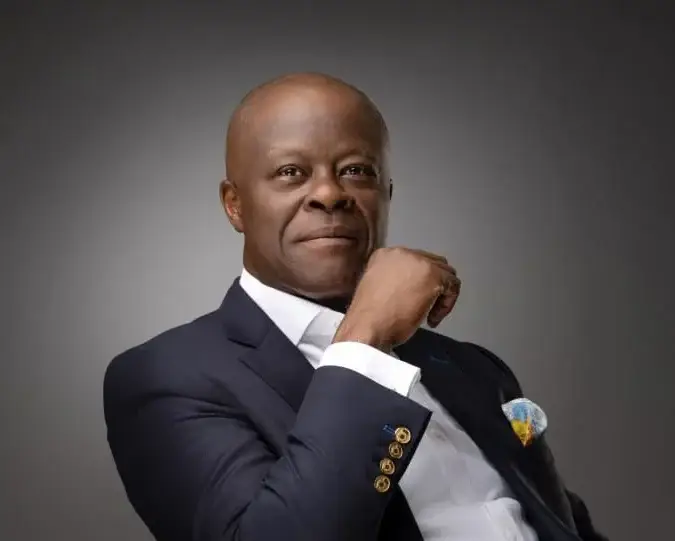

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, disclosed this at a press briefing in Abuja on Friday.

He said that Nigerians had huge funds in domiciliary accounts and held large sums abroad which could be deployed to rejuvenate the economy and that his team was working to provide the needed environment to attract such funds into the Nigerian economy.

According to the minister, Nigerians in the Diaspora were also expected to play a significant role in the fresh move to take the economy to a position of high growth, through productivity and efficient management of resources.

His words: “What we can see is that really, there is quite substantial sources of foreign exchange in Nigeria.

“There is a lot of cash outside the system, which if brought into the system, increases the money supply of dollars, increases in reserves and so forth.

“There are funds in domiciliary accounts, which if you give people the incentives they will utilize those for investment in Nigeria.

“Nigerians in Nigeria have huge holdings of foreign currency in banks abroad in financial institutions abroad.

“We need to provide the environment that brings those funds home to choose to invest in Nigerian economy rather than foreign economies, which is what they are doing right now.

“If you place money in a bank abroad, you’re investing in a foreign economy. Finally, we also have huge source of funds from the diaspora.

“Nigerians living and working abroad, who of course, have their families here and who are interested in keeping a presence here; we have to encourage them to be willing to save in Nigeria, perhaps by improving payment mechanisms and so on and so forth; so we have do a lot to aim at them.

“There is plenty of hope and it is our determination to put in place the kind of structures and incentive framework that brings Nigeria money abroad and even Nigeria money outside the system into the financial and economic system to work, to create jobs for Nigerians.

“Mr. President believes in fiscal federalism.”

He added that while the federal government was taking steps to ameliorate the effects of the reform decisions, states and local governments, and indeed, wealthy Nigerians and corporate entities should help the poor out of the present challenges.

N5bn palliative

The minister disclosed that N2 billion, out of the N5 billion, palliative funds to states have been released.

He explained that the money was both grant from the federal government as well as borrowing by the state government, without specifying how much would be grant and what percentage was loan to states.

Mr. Edun admitted that Nigerians were passing through challenges due to the fiscal reforms embarked upon by the present administration but insisted that it would be temporary and necessary steps were being taken by the government to ease the pains of the people.

“Until benefits of removal of subsidy feeds through, and until the NNPCL’s revenue from oil production going up feeds through, there is a challenge to balance the books, particularly in terms of foreign exchange,” he said.

The minister stated that the present administration would eliminate borrowing to finance recurrent and that any borrowing to be undertaken would be to finance capital projects.

Fuel consumption falls to 30%

Meanwhile, the Group Managing Director (GMD) of the Nigerian National Petroleum Company Limited (NNPCL), Mr. Mele Kyari, disclosed that the nation’s fuel consumption has declined by 30 percent, following the removal of petrol subsidy by President Bola Tinubu.

According to Mr. Kyari, the reduction in fuel demand from about 66.7 million litres daily before the removal of subsidy to about 46 million currently, also meant a 30 percent reduction in NNPCL’s demand for foreign exchange to import fuel.

An elated GMD also disclosed that oil production has ramped up to 1.6 million barrels by Wednesday from a very poor position of less than 1 million a year and some months ago.

The GMD also explained that the $3 billion deal with the African Export-Import Bank (AFREXIM) was not a loan but a forward sale arrangement.