Bitcoin on verge of record high as investors bet on Trump’s victory

Bitcoin was close to $73,000 in Asian trade Wednesday, approaching a record high with investors keeping a cautious eye on the US presidential election.

The leading digital currency was trading around $72,470 at 0800 GMT, after climbing as high as $73,563.63 in late US trade, just shy of its all-time peak of $73,797.98 in March.

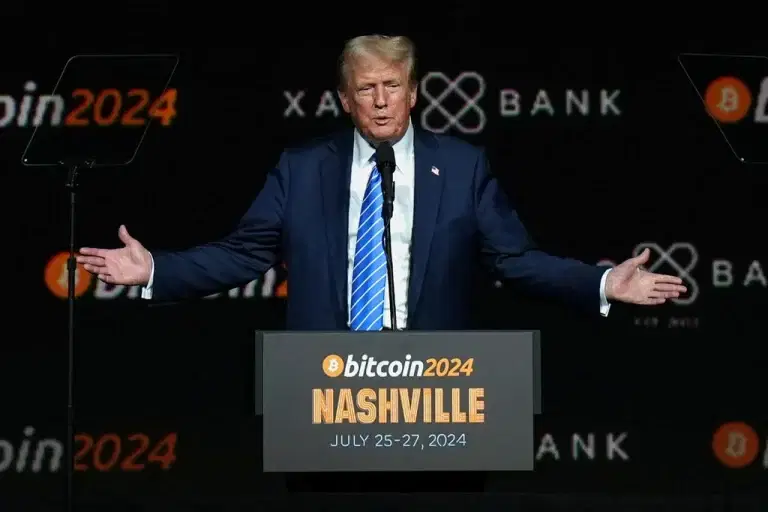

The surge in the price of bitcoin is seen as a bet on a Republican victory, as Donald Trump has emerged as the pro-crypto candidate.

The price of bitcoin closely follows Trump’s standing in the polls because a Republican victory would lead to an increase in demand for the digital currency, said Russ Mould, an analyst at AJ Bell.

During his presidency Trump referred to cryptocurrencies as a scam, but has since radically changed his position, presenting himself as a “pro-bitcoin president” if elected and even launching his own crypto platform.

With the uncertainty surrounding the very tight US election, safe-haven gold also reached a record high of $2,787.07 on Wednesday.

Oil prices rebounded slightly after falling sharply earlier in the week as fears of an escalation in the Middle East eased after Israel’s strikes on Iran avoided the country’s energy infrastructure.

“The broader performance in oil prices seems slightly discordant with what is happening across the globe,” said Daniela Sabin Hathorn, senior market analyst at Capital.com.

“It seems as if oil prices are ignoring improving economic data in the US and stimulus efforts from China to revive its struggling economy.”

Asian stocks fell following a mixed lead from Wall Street, with markets in a risk-off, wait-and-see mode ahead of the US election and the Federal Reserve’s rate decision next week.

Tokyo was virtually the sole advancer, closing one percent higher as the Nikkei continued its run-up on the yen’s weakness and tech gains. Manila was the only other market in the green.

Hong Kong led the decliners, falling 1.6 percent, while Shanghai, Sydney, Seoul, Singapore, Taipei, Kuala Lumpur and Bangkok also retreated.

In Europe, London, Paris and Frankfurt were all lower in opening trade.

“Asian markets are mostly down Wednesday, with investors on edge and wary of making big moves in local markets as the US presidential election looms large with pre-election de-risking taking hold,” said Stephen Innes, analyst at SPI Asset Management.

“Even China’s rumoured 10 trillion yuan ($1.4 trillion) stimulus plan is getting a lukewarm reception as investors weigh its potential impact — or lack thereof — on the broader economy,” he said.

Investors are hoping a key political meeting in Beijing next week will roll out a major stimulus plan for the Chinese economy, which has struggled to recover from the pandemic, with growth dragged down by a debt crisis in the property sector.

Markets are also awaiting a raft of key US economic data for more clues about the health of the world’s largest economy and the direction of the Fed’s interest rate policy.

Third-quarter GDP growth estimates will be released later Wednesday, with inflation data and the closely watched monthly labour market report out Thursday and Friday, respectively.

Data released Tuesday showed US job openings fell to the lowest level since 2021 and below market expectations, indicating the labour market could be cooling.

Yields on 10-year US Treasuries have edged up to above 4.3 percent this week, the highest since early July, suggesting that some market participants are increasingly counting on more limited rate cuts from the Fed at its November 7 meeting.

– Key Bitcoin figures around 0810 GMT –

Tokyo – Nikkei 225: UP 1.0 percent at 39,277.39 (close)

Hong Kong – Hang Seng Index: DOWN 1.6 percent at 20,380.64 (close)

Shanghai – Composite: DOWN 0.6 percent at 3,266.24 (close)

London – FTSE 100: DOWN 0.5 percent at 8,177.75

Euro/dollar: UP at $1.0841 from $1.0816 on Tuesday

Pound/dollar: UP at $1.3018 from $1.3010

Dollar/yen: DOWN at 153.12 yen from 153.57 yen

Euro/pound: UP at 83.28 pence from 83.13 pence

Brent North Sea Crude: UP 0.8 percent at $71.65 per barrel

West Texas Intermediate: UP 0.9 percent at $67.79 per barrel

New York – Dow: DOWN 0.4 percent at 42,233.05 (close)