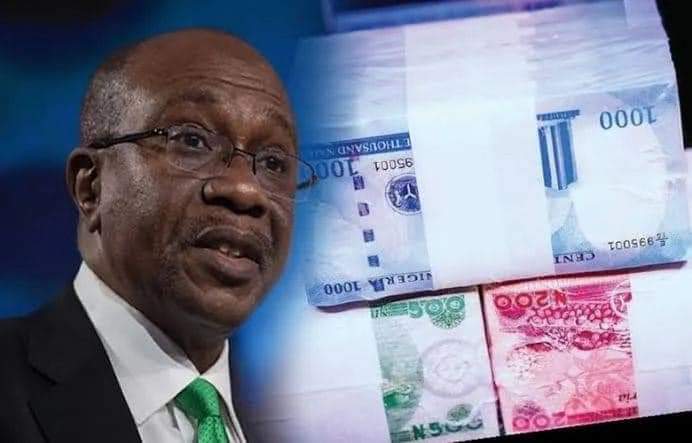

Supreme Court Judgement on the Naira Redesign Policy of Central Bank of Nigeria And Its Implications for the Nigerian Economy

It’s no longer news that on the 3rd of March, 2023 Nigerians received with mixed feelings the long awaited judgement of the Supreme Court of our land on the Central Bank of Nigeria (CBN) Naira Redesign Policy. The Apex Court resolved among other things that “the old version of the Naira notes shall continue to be legal tender with the new Naira notes until 23rd December, 2023.” This is perceived by finance experts as an erosion into CBN Autonomy that has the independent powers as given to it by the CBN Act to superintend over our Monetary Policy.

The Naira Redesign Policy was seen by Finance and Economics experts as a good one, apt and timely with enormous benefits, because a lot of money were outside Nigeria Banking System. The policy could have helped to stop the free fall of the Naira in the exchange market and stabilize Nigeria’s foreign exchange, reduce inflation since it was obvious that there was too much liquidity in the Nigerian economy which where outside the banking system. Even with the mop up by Banks, CBN still believes that over N900billion is still outside the banking system. It has been speculated that people have private vaults in their houses with a lot of illicit cash stockpiled there. Also, the policy would have strengthened the National Income Accounting by bringing in into the Banking System all these cash in private vaults, thereby helping monetary authorities to know, monitor and control liquidity (cash in circulation) also check money laundering and other illicit funds from finding their way into our economy.

However, the implementation of this policy was a bit clumsy particularly with the slow supply of the new notes, as law abiding citizens had immediately complied with CBN directives and moved all old notes in their possession to banks but could not access the new notes for their use. No doubt this brought untold hardship on the citizens with its adverse effects on the economy as a whole. This made some State Governors to approach the Supreme Court to stop the Federal Government from continuing with this policy and the Supreme Court in her wisdom has given their verdict on the matter.

This judgement, in trying to solve one problem, has created many new ones with far reaching implications to our already charged and fragile political economy. The issue now is that, banks have already mopped up old notes and had deposited same at the CBN for destruction, in place of new notes,and in Money Supply Policy of the CBN, the old notes don’t exist again and are marked for destruction.

The questions that will be begging for answers in view of this judgement are as follows:

- Will the CBN push back into circulation the same dirty old notes as deposited to them by banks?

- Will CBN direct its sister agency, the Nigeria Security and Miniting Company (NSMC) to start minting both old and new notes side by side?

- Who will be supplying the old notes to the economy since CBN has stopped minting it?

The implications of these are that bandits, looted funds, money laundrers, kidnappers, drug barons and all those in possession of illegally acquired funds that were afraid of Security Agencies apprehending them if they had approached the banks to deposit their old notes, will now have a window to push such money into the Nigerian economy by exchanging them directly in open market This is because CBN has stopped supplying the old notes into the economy and has concerned itself will minting and circulation of the new notes. But then, by this judgement, the old notes remain legal tender.

There will be a total confusion in Broad Money Supply Policy of CBN and a total distortion of the National Income Accounting. Money (old notes) will be coming into the economy from all sources now.

Kidnapping, money laundering, and drug dealings etc may return because too much cash in the economy increases all manner of crimes and they have opportunity through this judgement to bring into the economy these illicit funds.

I will recommend as follows:

1, CBN should not disobey the Apex Court in order not to increase the tension in the polity. Anything can ignite political or economic crisis. Which will in turn increase our economic woes.

- The Supreme Court re-word that judgement to read that 23rd December 2023, is the deadline for any one still in possession of old notes to deposit in the banks instead of allowing it to be operating side-by-side with the new notes because of its adverse effects on the economy.

The CBN while obeying the Supreme court judgement, should be strategic by encouraging the banks to accept the old notes but not to recirculate them, rather return them to CBN for destruction. Thus, before 23rd December 2023, all old notes would have disappeared from our economy and new notes would be in full circulation. This is a tough period for the management of CBN and monetary authorities.

Sir Cajetan Eberendu, Ph.D, FCILRM.

cj2big@yahoo.com

Insurance and Finance expert, sent in this piece from Abuja.