- Cardoso to unveil plan

- Govt cautions producers against export amid soaring gas price

Anew price management and stability framework that will lead to improvement in average living standards is underway.

The inflation management plan, soon to be unveiled by the Central Bank of Nigeria (CBN), is in conjunction with the Ministry of Finance and other relevant fiscal authorities, CBN Governor Olayemi Cardoso hinted at the weekend.

Nigeria’s headline inflation rate rose for the 10th consecutive month to 27.33 per cent last month, as against 26.72 per cent in September.

Food inflation stuck to an 18-year high at 31.52 per cent.

Rising inflation, underlined by continuing increases in costs of basic foods, logistics, energy and other living items, has undermined Nigerians’ living conditions and led to the depletion of savings and investments.

Spiralling inflation has posed a major challenge to global economic growth.

Widespread tightening of monetary policy, aimed at curbing inflation, has restrained economic activity and suppressed growth.

According to the International Monetary Fund (IMF), global growth is projected to slow from 3.5 per cent in 2022 to 3.0 per cent this year and 2.9 per cent next year, well below the historical average of 3.8 per cent achieved between 2000 and 2019.

Advanced economies are expected to experience a slowdown from 2.6 per cent last year to 1.5 per cent this year and 1.4 per cent next year as the impact of policy tightening takes hold.

Emerging markets and developing economies are projected to have a modest decline in growth from 4.1 per cent last year to 4.0 per cent in both 2023 and 2024.

Cardoso said the apex bank was revising the inflation-management framework to address the challenges of rising and unstable prices and foster stable and sustainable economic growth.

He said the CBN was well aware of the damage inflation has caused to living conditions and businesses, assuring that the new inflation-targeting framework would be effective in anchoring the apex bank’s agenda of price stability.

“As part of this refocus, the CBN has just approved the adoption of an explicit inflation-targeting framework to enhance the effectiveness of our monetary policy.

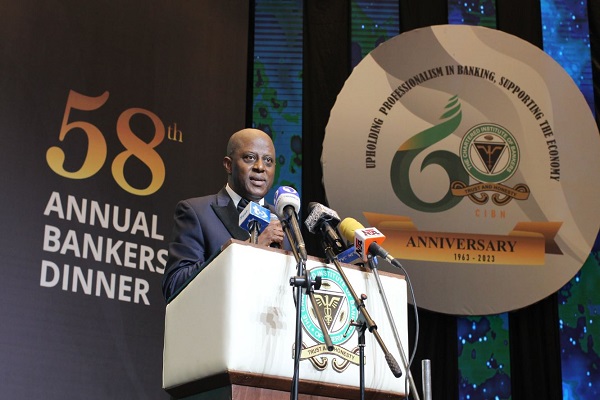

“The details and requirements for this framework are currently being finalised alongside the fiscal authorities,” Cardoso said during his lecture at the Chartered Institute of Bankers of Nigeria (CIBN) annual dinner in Lagos.

He recalled that he recently met with a group of small business owners and individuals who expressed their concerns about the impact of inflation on their operations and living conditions.

The CBN governor said: “They shared stories of struggling to maintain affordable prices for their customers while facing rising costs for raw materials and supplies.

“The instability caused by inflation not only affects their profit margins but also hampers their ability to plan for the future.

“These entrepreneurs stressed the need for price stability to create a conducive business environment that allows them to thrive and contribute to the economy.

“In recent discussions with individuals from different walks of life, I encountered a young family trying to make ends meet in the face of rising prices.

“They shared their worries about the erosion of their purchasing power and the challenges of meeting basic needs within a tight budget.

“They emphasised the importance of stable prices to protect the well-being of ordinary citizens and ensure a fair distribution of resources.

“It is crucial that we prioritise price stability to safeguard the livelihoods of our fellow Nigerians,” Cardoso said.

He explained that while the country’s inflationary trend was due to both global and domestic challenges, well-crafted monetary and fiscal policies could ease domestic price pressure.

Cardoso noted that in response to the inflationary pressures caused by the surge in energy prices resulting from the Russia-Ukraine conflict, monetary authorities worldwide had raised policy interest rates, which led to tighter global financial market conditions and significant outflows of funds from emerging market countries such as Nigeria.

According to him, these developments have strengthened the dollar, exacerbating inflationary pressures while weakening currencies and depleting external reserves in many emerging market countries such as Nigeria.

As a result, several central banks in emerging markets and developing economies have implemented restrictive policies to contain rising inflation and reduce capital outflows.

He, however, pointed out that the domestic factors affecting Nigeria’s economic performance are wide-ranging, encompassing both social and economic aspects.

“Insecurity remains a pressing issue, affecting the agricultural, industrial, and services sectors simultaneously.

“The persistently high levels of insecurity have resulted in decreased national output and productivity, as many farmers have been unable to access their farmlands, disrupting supply chains and major economic activities. This has led to food shortages and inflation in various parts of the country.

“Infrastructure constraints also pose significant challenges, undermining the production chain and distribution network of goods and services.

“Additionally, issues such as business bottlenecks and a culture of poor service delivery, particularly within the public sector, further hinder the fortunes of the Nigerian economy.

“Addressing these challenges requires a well-crafted structural policy, complemented by coordinated monetary and fiscal policies,” Cardoso said.

According to him, he and the Minister of Finance and Coordinating Minister of the Economy Wale Edun are meeting on how to address the critical issues.

Cardoso laid out the efforts aimed at controlling inflation and other key policy priorities of his administration at the 58th Annual Bankers’ Dinner and Grand Finale of the 60th CIBN anniversary.

According to him, a thorough assessment of the economy reveals significant challenges, including high and rising inflation, inadequate foreign exchange supply, depreciation of the exchange rate, limited external reserves, weakened output, and high unemployment.

He noted that the challenges have pushed up interest rates, discouraging investments in productive activities while high inflation has affected asset quality and solvency ratios in the banking sector, just as persistent depreciation of the naira poses a significant risk for domestic banks with foreign exchange exposures.

He said the focus of his administration at the apex bank would not be a figurative expression of data but to achieve meaningful improvements in the living conditions of Nigerians.

Cardoso said: “To address these challenges, the CBN is committed to achieving monetary and price stability. This is not just a technical objective, but it has real-life implications for the well-being of our citizens.

“Through targeted policies, transparent market operations and coordination between monetary and fiscal authorities, we can ensure a more stable exchange rate, control inflation, and create an enabling environment for businesses and individuals to thrive.”

He added new foreign exchange guidelines and legislation would be developed to ensure clarity, transparency and harmonisation of operating rules, which are essential for the proper functioning of domestic and foreign currency markets.

The CBN governor said policy formulation and assessment will be continuously monitored as key macroeconomic indicators on fiscal and monetary activities would be tracked, diligently evaluated, and necessary adjustments made if things are not pointing in the right direction or moving at the right pace.

According to him, the key indicators to be tracked include consumer price indices; headline and core inflation rates; Gross Domestic Growth (GDP), tax-to-GDP; per capita income; balance of payments, foreign exchange reserves, unemployment rate, as well as more granular measures that the apex bank uses in assessing stability of the financial system.