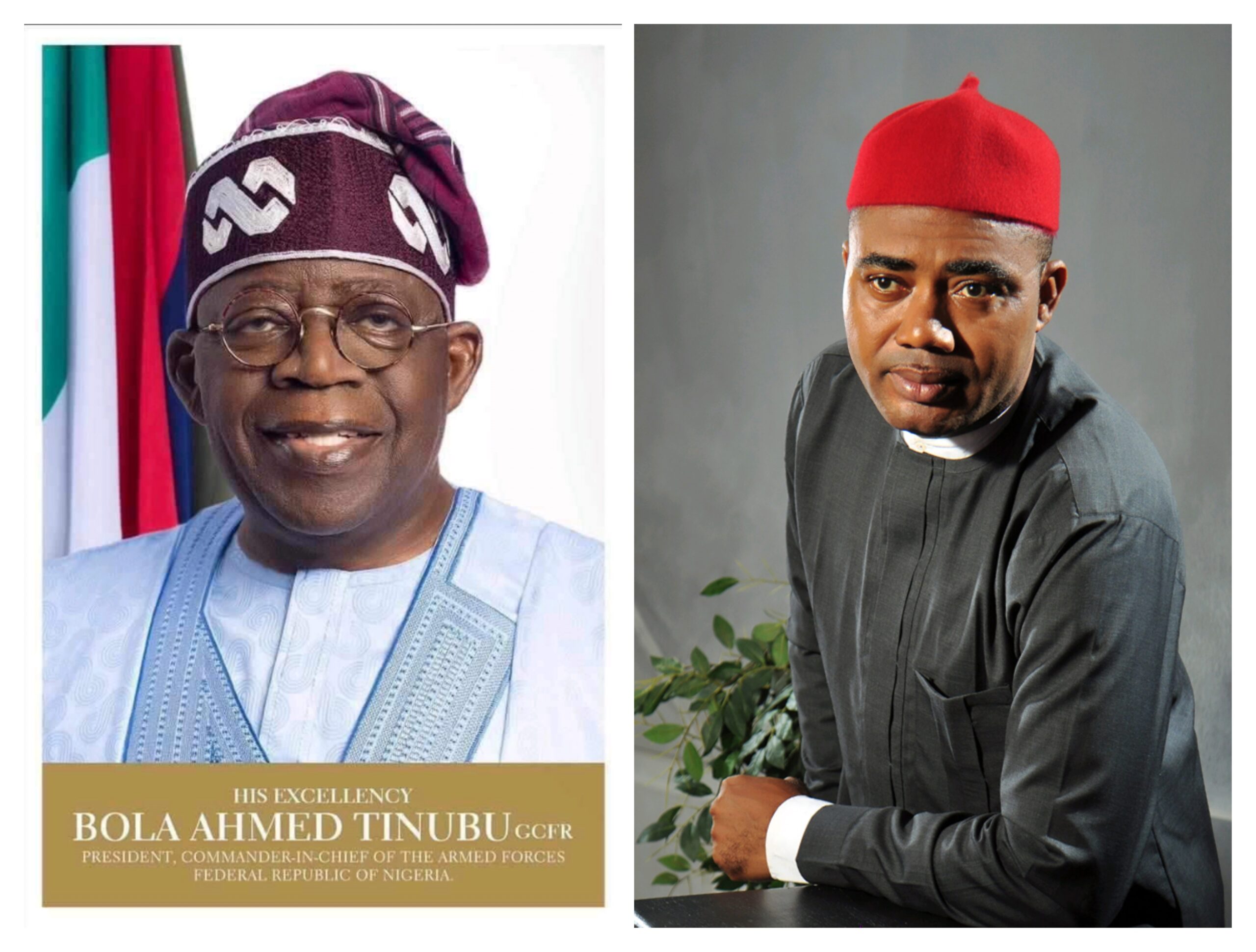

The President Tinubu Student’s Loan: A Quick Review

© Cajetan Eberendu

Ph.D, KSM, FCILRM.

Nigerians woke up a couple of days ago to receive the news of Mr. President, His Excellency, Bola Ahmed Tinubu signing the Students’ Loan Bill into law. This Act, when it becomes fully operational intends to provide loans for Students of Tertiary Education to pay school fees, accommodation, buy text books, research materials, or any other purpose as justified by their various institutions. The amount to be given will vary. Those in Technical Courses will get more than those in Non-Technical courses. This loan is targeted at students from poor homes or those whose parents are with income below N500,000 per annum. There are other conditions for eligibility and disqualification.

This Student’s Loan Act will also establish an Education Bank, which will handle the responsibility of mobilizing the funds and dispense the loan to deserving applicants. This Education Bank will start with N1 billion Share Capital and the Federal Government will have 100% equity holding.

The Act will also establish a fund called the Students Loan Fund to be managed by the Education Bank and be made accessible to the deserving students.

This Fund will be sourced as follows:

A. Through floating of Education Bonds.

B. All interests arising from the deposits in the banks.

C. Education endowment fund schemes.

D. 1% of taxes, levies, and duties to FG through FIRS, NIS, and Customs.

E. 1% of profits from oil and other natural resources.

F. Grants, gifts, and any other endowments.

In the Act, there are penalties for defaulters, which is 2 years imprisonment or fine of N500,000.

This loan is good news that will help young people desirous of tertiary education to get it, irrespective of their backgrounds, and start the repayment starting two years after the National Youth Service Corps (NYSC).

This is a welcome development because tertiary education all over the world is a costly project. This idea has helped so many people attend tertiary institutions of their choice, acquiring academic degrees of their dreams. I read sometime where President Obama was saying that his degree in Law at the prestigious Harvard University was possible because of the American Student Loan Scheme. This is a laudable initiative and should be supported.

The Education Bank, when established, will also create employment because there will be need for experts to manage the fund, implement, and monitor the loan. The Bank will also stimulate the economy through various investment outlays that it will create.

However, this review is to educate possible applicants that the educational loan is different from bursary allowance, scholarship, and grants. While the former must be repaid with interest, the latter are not repayable. Therefore, the student loan is not a freebie. It must be repaid so other students coming behind can access it, too.

Furthermore, anyone who will be interested in this student loan should have it at the back of their mind that it is not free money by the government or avenue to “settle the boys”. This is a well thought out programme that has the potential to benefit the entire economy if well handled.

However, this project will face some challenges both at the teething stage (short run) and at the maturity stage (long run). Some of the short run challenges are:

- How to identify genuine applicants from numerous Nigerian youths.

- Ensuring that the loan is not being diverted into other businesses unrelated to education.

- Ensuring that it will not be hijacked by political jobbers and funds diverted into private accounts, etc.

If the government and those appointed to manage the Educational Bank cross these initial hurdles, they will also face the challenge of recovery of loans at maturity due to:

- Unemployment

- Underemployment

- Harsh business environment and no access to capital for those who want to start up small businesses for those that self employed.

I would also recommend that the government study what happened to The People’s Bank under the General Ibrahim Babangida military administration. The People’s Bank was also a laudable initiative that was supposed to create loan for the masses to be revolved around to create strong small and medium scale enterprises in Nigeria, but the Bank failed after few years of operation because of bad loans and poor management. I think the study of why the People’s Bank failed will help both the government and those who are appointed to manage this fund succeed.

Cajetan Eberendu,

Insurance/Finance expert.

Sent in this from Abuja.